Day 10 started with a visit to Stanford! What a beautiful campus! It is an incredibly inspiring place!

We went to meet Nikkie from the Stanford Technology Ventures Program. They organize all kinds or courses and lectures for their students. They have great lectures with amazing founders. They also arrange internships for their students where they go and work in startup companies, next to the CEO to see how it works. The founders of Instagram studied at Stanford and the founder of Yahoo too, he had built a building in Stanford, as thank for his amazing time there. It is overall known that Stanford students are a good match for entrepreneurs. It was nice to talk to Nikkie and get to know some more details about how they support students to become entrepreneurs.

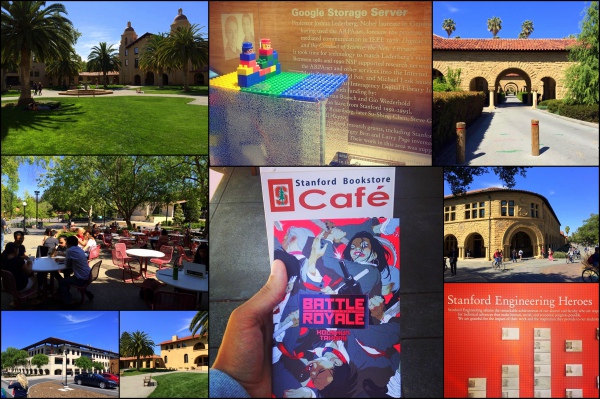

After our talk with Nikkie, we walked around the campus, visited the famous bookstore and looked at the biking students, great buildings, palmtrees and green lawns!

|

After this meeting, we went to Venrock for a meeting with Steve Goldberg. He started as an hardware engineer, then worked as a manager, then was VP of engineering, then four times CEO of different companies and then he ended up at Venrock.

The startups did an elevator pitch for Steve and then he told us a bit about Venrock. Venrock started as a family business. The Rockefellers family was one of the richest families in the world in the twenties. But he wasn't a very nice guy... His son felt bad for his dad's behaviour and he started giving money away to business: the start of early stage venture capitalism.

In 1969, it became Venrock, and until 1995 it only used the family money. After that, they had some limited partners who also invested and now they are completely independent from the family. They have about 120 active companies. They invested in Apple, Cloudfair, Castlight,... They invest for one third in health care and for two thirds in other spheres.

It is really hard to get Series A and B investments. If you look at the years 2000 until 2010, the average return was negative. There were more than 1000 venture funds, now things call down a bit, and some companies are doing great.

Some of the superhot markets now are internet security, consumer software and hardware (but it's hard to make money here...)

The general idea on Sand Hill Road (where most of the VCs have their office) is go big or go home! So before you talk to a VC, you should think about what that means for your company.

The most important things the investors look at are the team (you need relevant experience), having a clear view of the market and have a great execution plan! No one can predict the future, but your plan has to make sense. It doesn't matter what the numbers are, but they have to make sense. And of course, traction and customer validation is very important!

He also explained that when a VC says no, it often has nothing to do with you and your company. He might just have signed a deal, he might have a competing company in his portfolio, he might be at the end of a fund or he might have a bad history with your market.

|

Venrock invests about $20M in each company (not all at the start), they have 35 to 40 companies per fund. Steve sees 10 companies a week, so about 500 a year and he only does about one deal/year! All 15 partners have to agree to sign a deal. They are very hands-on. They are active in the board of all their companies and stay with the company forever. They never take more than 20% in a company. Steve says: "There's no piece of the pie if there is no pie."

After the meeting with Steve, we had our Beerparty in Mountain View. There was beer, food, music and lots of networking! Happy Farm mentors, Oded Hermoni and Artem Gassan joined us and a lot of other amazing guests! It was a nice end of the day. Photo's follow soon!

|

Live comment